georgia property tax exemptions disabled

The exact rate changes depending on the fluctuation rate set by the Secretary of Veterans Affairs. The amount of the exemption for 2021 is 101754 and is updated annually by the Veterans Administration.

Property Tax Homestead Exemptions.

.png)

. Property Tax Returns and Payment. You must be at 100 permanently and totally disabled and you must meet certain income requirements. Ad Access Tax Forms.

A disabled veteran in Georgia may receive a property tax exemption of 60000 or more on hisher primary residence if the veteran is 100 percent disabled depending on a fluctuating index rate set by the US. A letter from the Veterans Administration stating that the veteran has a 100 Service Connected Disability and is totally and permanently disabled is required to qualify for this exemption GA Code 48-5-48. The value of the property in excess of this exemption remains taxable.

This exemption is extended to the un-remarried surviving spouse or minor children. Secretary of Veterans Affairs. If youre 62 years old or older and living within a school district and your annual family income is 10000 or less then up to 10000 of your.

Ad Download Or Email Form ST-5 More Fillable Forms Try for Free Now. County Property Tax Facts. The amount is 93356 during FY 2022 per 38 USC.

Get Ready for Tax Season Deadlines by Completing Any Required Tax Forms Today. See Why Were Americas 1 Tax Preparer. Pensions and disability income up to the maximum.

Property in excess of this exemption remains taxable. If you are a 100 disabled veteran you may be eligible for additional amounts of exemption. The state of Georgia takes good care of its veterans with the veteran exemption laws.

Complete Edit or Print Tax Forms Instantly. If you are 65 years old or older and your net income the previous year wa s 10000 or less you qualify for a 4000 property tax exemption. Any questions pertaining to tax exemptions at the local level should be asked to and answered by your County Tax Commissioners office.

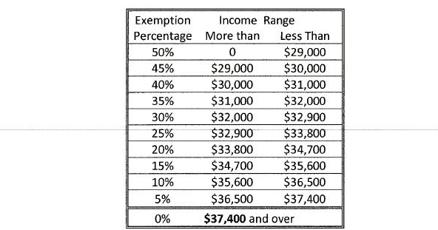

Age 65 state exemptions for Net income less than 10000 must be age 65 on January 1st of that tax year. DeKalb County offers our disabled residents special property tax exemptions. Any qualifying disabled veteran may be granted an exemption of up to 50000 plus an additional sum from paying property taxes for county municipal and school purposes.

The current amount is 85645. It helps younger retirees ages 62 to 64 too. The qualifying applicant receives a substantial reduction in property taxes.

Property Tax Exemptions for Disabled Veterans by State Alabama Property Tax Exemptions. Disabled Person - 50 School Tax Exemption coded L5 or 100 School Tax Exemption coded L6 If you are 100 disabled you may qualify for a reduction in school taxes. Basic Homestead Code L1 You must own your home and reside in the home on January 1st of the year in which you apply for the exemption.

To apply for a disabled exemption you will need to bring your Georgia drivers license your Social Security Awards Letter and one Doctors Affidavit completed by your doctor. In 2022 the additional sum is. Further Georgia has an exclusion from state income tax that is directly targeted at seniors.

Individuals 65 years or older may claim an exemption from all state ad valorem taxes on their primary legal residence and up to 10 acres of land surrounding the residence. Any qualifying disabled veteran may be granted an exemption from paying property taxes for state county municipal and school purposes. The additional sum is determined according to an index rate set by United States Secretary of Veterans Affairs.

Under Alabamas homestead exemption. If you are above a certain age and have the qualifying income you may be eligible for additional amounts of exemption. Property of a nonprofit home for the aged and property of a nonprofit home for the mentally disabled as long as no income or profit is distributed to any private person when the home is qualified as an exempt organization under the United States Internal Revenue Code section 501c3 and OCGA.

The exclusion allows a retiree who is 65 year or older to shield from state income taxes up to 65000 in pension or investment income a year if single 130000 a year if married. You must meet several criteria to qualify for the. See If You Qualify To File State And Federal For Free With TurboTax Free Edition.

Georgia provides 100 disabled vets a property tax waiver of at least 50000 on their primary residence. Qualified veterans in Georgia may receive a property tax exemption for a primary residence of up to 50000 plus an additional amount which varies annually. 140 HENRY PARKWAY MCDONOUGH GA 30253 164 BURKE STREET STOCKBRIDGE GA 30281 770-288-8180 opt.

Any qualifying disabled veteran may be granted an exemption of 81080 from paying property taxes for state county municipal and school purposes. Currently there are two basic requirements. Age 62 exemptions net income less than 10000.

Property Taxes in Georgia. Property Tax Millage Rates. There are several homestead exemptions offered by the State of Georgia that apply specifically to senior citizens.

Ad File Your State And Federal Taxes With TurboTax. S5 - 100896 From Assessed Value. Disabled veteran - Letter required - Essentiallyt his exemption is 90364 off the assessed value 40 of appraised value and applies to state county city and school board taxes.

To obtain verification letters of disability compensation from the Department of Veterans Affairs please call 1-800-827-1000 and request a Summary of Benefits letter. The value of the property in excess of this exemption remains taxable. Therefore it is always essential to determine the exemption you qualify to receive each year.

Heres how it works. To continue receiving this benefit a letter from the Veterans Administration. Suite 203 - Real Property Tax Returns and Homestead Applications Suite 213 Personal Property Division.

The exemption will reduce the assessed value for county taxes by 15000 and 4000 for school. Up to 25 cash back Senior Citizen Exemptions From Georgia Property Tax. The GDVS can only verify the status of a.

As a disabled veteran or the widow of a disabled veteran who has passed or if youre the widow of a veteran who died in battle Georgia provides substantial property tax exemptions.

.png)

Homeowners Find Out Which Property Tax Exemptions Automatically Renew This Year Cook County Assessor S Office

States With Property Tax Exemptions For Veterans R Veterans

What Is A Homestead Exemption And How Does It Work Lendingtree

Find Out If There Are Any States With No Property Tax In 2020 Which States Have The Lowest Property Taxes States Property Tax Property Real Estate Investor

Property Taxes Calculating State Differences How To Pay

States That Fully Exempt Property Tax For Homes Of Totally Disabled Veterans

Public Hearing To Address Property Tax Exemptions News Oswegocountynewsnow Com

Public Hearing To Address Property Tax Exemptions News Oswegocountynewsnow Com

Homeowners To See Higher Property Taxes Thanks To The Pandemic Here S What They Can Do Equitax

Property Taxes By State In 2022 A Complete Rundown

Press Release Announcing A Proposed Property Tax Increase

Qualifying Trusts For Property Tax Homestead Exemption Sprouse Shrader Smith

Property Overview Cobb Tax Cobb County Tax Commissioner

2022 Property Taxes By State Report Propertyshark

Frequently Asked Questions Faq About Georgia Property Tax Appeals Hallock Law Llc Property Tax Appeals